Project Update

Feasibility Study:

Feasibility Study was carried out by URS Scott Wilson, UK and approved by the Panel of Experts (PoE) constituted by PPIB on December 20, 2011.

During the EPC contract negotiation the feasibility design optimization was proposed by the EPC Contractor which was duly verified by the Company’s technical consultant PJ Rae Associates Canada reducing the hydraulic losses leading to increase in installed capacity from 640MW to 700.7 MW and reducing the hydraulic losses leading to increase in installed capacity from 640MW to 700.7 MW and increased generation from 3075 GWh to 3265 GWh within the same ICB lowest bid price. The design optimization was duly approved by PPIB POE, after study by ACE, leading independent engineers, on 22 December 2017.

Letter of Interest/Letter of Support

The Letter of Interest dated 27 April 2007 was issued by Private Power & Infrastructure Board (Ministry of Water & Power) to conduct feasibility study. The Letter of Support, as amended from time to time, was issued by PPIB on 30 Jun 2016 with the authority to develop the Project and achieve financial close on or before 31 December 2024.

Project Cost:

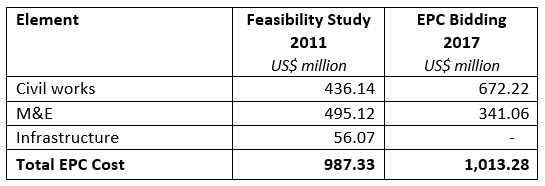

The initial project cost was established in the feasibility study prepared by URS Scott Wilson and approved by PPIB/POE on 24 January 2012. The actual project cost was determined through a transparent international competitive bidding process with oversight from renowned, independent engineering company Montgomery, Watson, Harza, (MWH) USA, a hydropower specialist company with close to two hundred years of experience. A comparison is shown below:

Based on a transparent international bidding process, after detailed due diligence and examination of the process and results, the EPC cost was accepted by NEPRA and the EPC stage tariff determined. It can be seen from the above that the M&E cost was reduced by over 30% as a result of the bidding process. The civil works cost was expected to increase due to the natural escalation of construction materials and in actual fact has increased in consort with the relevant Pakistan CPI for such materials.

EPC Contract:

The EPC Contract was executed with China Gezhouba entities on 11 June 2017. The EPC Contract is structured as an onshore civil works contract and an offshore supply contract covering imported M&E plant and equipment for permanent installation in the power generating complex.

The Contract includes provisions for adjusting the contract price for changes in costs for cement, fuel, steel reinforcement and labour due to variation in applicable prices/indices published by Pakistan Bureau of Statistics from the specified base date (November 2016) through construction to COD.

Tariff:

The tariff for hydropower projects is determined by NEPRA in three stages:

For all other power projects there are only two stages of tariff determination i.e., EPC and COD.

The hydropower feasibility study, evaluates hydrological, seismic and geological risks, which are important for developers and investors to evaluate the project and make rational technical and commercial investment decisions to proceed with development which often takes upto two decades. In fact, the viability of the site to generate sustainable hydropower is only formally established and accepted after the bankable feasibility study is prepared and approved by the PPIB/POE. Due to the very long development period for hydropower projects NEPRA issues a feasibility stage tariff at this point so that developers can have a predictable and rational basis to continue investment and develop the projects.

NEPRA determined the various tariffs as follows:

Project Land:

Acquisition of private, public and forest land required for the project together with replacement of affected trees and re-settlement is a key component for hydropower projects and is a complex and difficult process.

The process, for land acquisition of 12,602 Kanals (approx. 1,300 acres), both in Punjab and AJ&K jurisdictions, started in 2017 under the Land Acquisition Act 1894 (LAA) with relevant notices served under the Act and a process of evaluation of fair cost starting. The total cost of US$ 20 million to date was fully funded by the Sponsors as 100% equity. The process for land acquisition is substantially complete and the private land has been completely acquired and agreements u/s 41 of land Acquisition Act have been executed while a few processes in relation to the government and forest land are outstanding and shall be completed well before financial close of the Project.

Concession Documents:

The process of negotiating and executing the concession documents started in 2017 and was concluded with execution as follows:

Power Evacuation:

The Executive Committee of the National Economic Council (ECNEC) in its meeting held on August 28, 2013, approved the project of “Transmission Scheme for Dispersal of Power from Neelum-Jhelum, Karot and Azad Pattan Hydro Power Projects” and NTDC approved the Grid Interconnection Study for the project on 10 November 2017.

According to the approved interconnection scheme, the power will be evacuated from the project through Suki Kinari to Maira 500 kV double circuit transmission line which will be running parallel along river Jhelum on its right bank and will also evacuate power from Suki Kinari HPP, Kohala HPP and Mahal HPP.

Environment:

The project straddles the River Jhelum and thus comes under the purview of both AJ&K and Punjab Environmental Authorities.

The Environmental and Social Impact Assessment (EIA) and Environmental Approvals by EPA AJK and Punjab were issued on 02 November 2012 and 08 November 2012 respectively.

The updated Environmental and Social Impact Assessment (ESIA) Study prepared by Hagler Bailly Pakistan was approved during March 2018 thus leading to issuance of Environmental NOCs from the respective authorities.

China-Pakistan Economic Corridor (CPEC):

As a key and important hydropower project in the River Jhelum Cascade, the project included in the CPEC- Energy Actively Promoted Project in the 9th JCC in 2019. See http://cpec.gov.pk/energy

Clean Development Mechanism:

The project generation of 3,265 GWh per annum will replace thermal generation and result in annual emission reductions of some 1.5 million tons which would entitle the company to certified emission reductions (CERs) of 1.5 million tons.

The PDD was uploaded for public comment on the UNFCCC web site which can be viewed at: https://cdm.unfccc.int/Projects/Validation/DB/DZFS0QLBPVPUHF7J6RTTHVA1NYBYJD/view.html. No comments were received during the comment period.

Due to the CDM uncertainty and very low CER price the process has been slowed down but will be completed before financial close as part of the Company’s environmental responsibility and to place it in line for any future emissions trading scheme of other international carbon reduction initiative.

Insurance:

Joint venture of (a) Marsh (China) Insurance Brokers Co. Limited, (b) Unique Insurance Brokers (Private) Limited, Pakistan and (c) Huatai Insurance Agency & Consultant Service Limited, China was appointed as Insurance Broker for the Company. Insurance Policies issuance currently under review and finalization.

Engineering:

The huge and complex construction activity for hydropower projects requires a massive engineering effort and services are employed as follows:

1. EPC Contractors design and engineering services. 2. Owner (Company’s) Engineer. 3. Power Purchaser’s Independent Engineer. 4. Re-opener verifier Engineer. 5. Lenders technical Engineer.

These engineers coordinate amongst each other and approve design, plans and as-built results together with requirement to meet performance and quality standards. A joint venture of Mott MacDonald Limited, UK, Pearl River Planning Surveying and Designing Co. Limited, China and MM Pakistan Private Limited was appointed as Owner Engineer on 17 December 2019.

Financial Close:

Term Sheet defining key terms and conditions agreed between the Company (borrower) and the Lenders Consortium was executed on 5 January 2021 followed by execution of the Facility Agreement on 31 December 2021. The security documents and other financing documents are substantially negotiated and finalized and shall be executed in due course.

All key consents and approvals under the concession documents and/or the Facility Agreement are secured except for few which are sequential in nature and shall be obtained at an appropriate time before financial close.